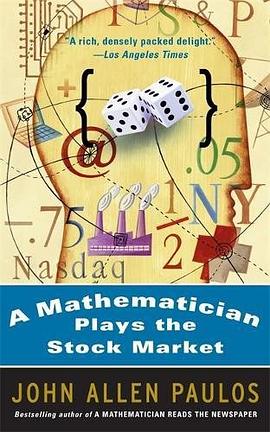

A Mathematician Plays The Stock Market pdf epub mobi txt 电子书 下载 2025

- 投资

- 数学

- 股票

- 财经

- trader

- 财政

- 随笔

- 英文版

- 数学

- 金融

- 股市

- 投资

- 概率

- 经济学

- 量化分析

- 行为金融

- 市场心理学

- 财富

具体描述

From America's liveliest writer on mathematics, a witty and insightful book on the stock market and the irrepressibility of our dreams of wealth. In A Mathematician Plays the Stock Market best-selling author John Allen Paulos demonstrates what the tools of mathematics can tell us about the vagaries of the stock market. Employing his trademark stories, vignettes, paradoxes, and puzzles (and even a film treatment), Paulos addresses every thinking reader's curiosity about the market: Is it efficient? Is it rational? Is there anything to technical analysis, fundamental analysis, and other supposedly time-tested methods of picking stocks? How can one quantify risk? What are the most common scams? What light do fractals, network theory, and common psychological foibles shed on investor behavior? Are there any approaches to investing that truly outperform the major indexes? Can a deeper knowledge of mathematics help beat the odds? All of these questions are explored with the engaging erudition that made Paulos's A Mathematician Reads the Newspaper and Innumeracy favorites with both armchair mathematicians and readers who want to think like them. Paulos also shares the cautionary tale of his own long and disastrous love affair with WorldCom. In the tradition of Burton Malkiel's A Random Walk Down Wall Street and Jeremy Siegel's Stocks for the Long Run , this wry and illuminating book is for anyone, investor or not, who follows the markets-or knows someone who does.

作者简介

目录信息

读后感

书的内容比较有趣,但翻译有些糟糕。以作者不断向下摊平世通的股票(因为它在跌)为主线进行的写作,颇有真实感。摘要如下 1 地下信息向公共信息(我们知道别人知道的,并且他们也知道我们知到……总之,公认的信息)转化需要时间。 2 一些偏见:锚定,可见性偏见,证实偏见...

评分看了一小半,就发现2个例子完全错误啊。列出来,欢迎质疑: 一:有十个股票每周随机一个会大涨,一个随机选股票,一个用Q策略 这个例子,两人又大收益的概率应该是一样啊,都是1/10。而不是书中的随机选股的才1%。 二:扔骰子决定上下楼梯那个例子,方法S的算术平均收益是负...

评分看了一小半,就发现2个例子完全错误啊。列出来,欢迎质疑: 一:有十个股票每周随机一个会大涨,一个随机选股票,一个用Q策略 这个例子,两人又大收益的概率应该是一样啊,都是1/10。而不是书中的随机选股的才1%。 二:扔骰子决定上下楼梯那个例子,方法S的算术平均收益是负...

评分看了一小半,就发现2个例子完全错误啊。列出来,欢迎质疑: 一:有十个股票每周随机一个会大涨,一个随机选股票,一个用Q策略 这个例子,两人又大收益的概率应该是一样啊,都是1/10。而不是书中的随机选股的才1%。 二:扔骰子决定上下楼梯那个例子,方法S的算术平均收益是负...

评分看了一小半,就发现2个例子完全错误啊。列出来,欢迎质疑: 一:有十个股票每周随机一个会大涨,一个随机选股票,一个用Q策略 这个例子,两人又大收益的概率应该是一样啊,都是1/10。而不是书中的随机选股的才1%。 二:扔骰子决定上下楼梯那个例子,方法S的算术平均收益是负...

用户评价

坚持读完了,一本没深度还错误百出,没系统性的书

评分讲的不错,解决了每个人投身股市的心理问题。

评分讲些基本道理吧, nothing new.

评分mathematical metaphors that may have something to do with the stock market

评分mathematical metaphors that may have something to do with the stock market

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2025 book.quotespace.org All Rights Reserved. 小美书屋 版权所有