具体描述

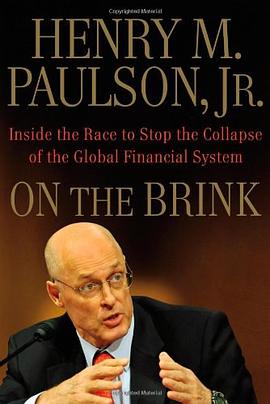

When Hank Paulson, the former CEO of Goldman Sachs, was appointed in 2006 to become the nation's next Secretary of the Treasury, he knew that his move from Wall Street to Washington would be daunting and challenging.

But Paulson had no idea that a year later, he would find himself at the very epicenter of the world's most cataclysmic financial crisis since the Great Depression. Major institutions including Bear Stearns, Fannie Mae, Freddie Mac, Lehman Brothers, AIG, Merrill Lynch, and Citigroup, among others-all steeped in rich, longstanding tradition-literally teetered at the edge of collapse. Panic ensnared international markets. Worst of all, the credit crisis spread to all parts of the U.S. economy and grew more ominous with each passing day, destroying jobs across America and undermining the financial security millions of families had spent their lifetimes building.

This was truly a once-in-a-lifetime economic nightmare. Events no one had thought possible were happening in quick succession, and people all over the globe were terrified that the continuing downward spiral would bring unprecedented chaos. All eyes turned to the United States Treasury Secretary to avert the disaster.

This, then, is Hank Paulson's first-person account. From the man who was in the very middle of this perfect economic storm, ON THE BRINK is Paulson's fast-paced retelling of the key decisions that had to be made with lightning speed. Paulson puts the reader in the room for all the intense moments as he addressed urgent market conditions, weighed critical decisions, and debated policy and economic considerations with of all the notable players-including the CEOs of top Wall Street firms as well as Ben Bernanke, Timothy Geithner, Sheila Bair, Nancy Pelosi, Barney Frank, presidential candidates Barack Obama and John McCain, and then-President George W. Bush.

More than an account about numbers and credit risks gone bad, ON THE BRINK is an extraordinary story about people and politics-all brought together during the world's impending financial Armageddon.

作者简介

Henry M. Paulson, Jr. served under President George W. Bush as the 74th Secretary of the Treasury from June 2006 until January 2009. Before coming to Treasury, Paulson was Chairman and Chief Executive Officer of Goldman Sachs since the firm's initial public offering in 1999. He joined Goldman Sachs Chicago Office in 1974 and rose through the ranks holding several positions including, Managing Partner of the firm's Chicago office, Co-head of the firm's investment Banking Division, President and Chief Operating Officer, and Co-Senior partner.

Prior to joining Goldman Sachs, Paulson was a member of the White House Domestic Council, serving as Staff Assistant to the President from 1972 to 1973, and as Staff Assistant to the Assistant Secretary of Defense at the Pentagon from 1970 to 1972.

Paulson graduated from Dartmouth in 1968, where he majored in English, was a member of Phi Beta Kappa, and an All Ivy, All East football player. He received an M.B.A. from Harvard in 1970.

目录信息

读后感

(上篇)http://book.douban.com/review/3048595/ Henry M. Paulson Jr.,男童军(boy scouts)最高级鹰章获得者,全美高中摔跤比赛冠军,全美大学ΦΒΚ学术荣誉协会会员,1972年哈佛商学院MBA,毕业后任职美国国防部,1974年加入高盛芝加哥投资银行部,1999年成为高盛上市后...

评分保尔森是做销售出身,大部分时间都在跟人打交道包括打电话,这本回忆录也是根据通话记录写的,就像流水账,不像伯南克有一定的理论。伯南克的《The Courage to Act》主要看的是联储紧急提供流动性、降息和QE,但金融危机最后能稳定,主要靠的是TARP,这方面就是财长去和国会争...

评分干我们这行,看书最大的问题就是很少有整块的时间,最多有连续的一两个小时可以看书,有极少数整块的时间也要用来准备各种考试,所以工作后看完的书以一两个小时就能看一小半的各种中文自传、口水书、小说为主。往前看,在这本on the brink和《少有人走的路》之前,最早...

评分作者记录了从金融危机开始到政府救助结束他的第一人称视角。每一天,跟谁,在哪里,开会或谈话的内容。应该算是一个很详实的史料记录,适合以后的历史研究者做资料引用,遗憾的是很少有跳出记叙而画龙点睛的评论。 如果你想知道这场危机发生的深层原因,或者谁应该负什么样的...

评分用户评价

《On the Brink》这个名字,对我来说,与其说是一个书名,不如说是一种体验的邀请。我一直对那些描绘人类在极端环境下如何生存的书籍抱有浓厚的兴趣,因为我相信,在最艰难的时刻,才能最清晰地看到人性的本质。我猜想,这本书可能围绕着某个关键性的时刻展开,在这个时刻,一切都岌岌可危,就像站在悬崖的边缘。我好奇作者会如何设置这个“边缘”的情境,是自然灾害?社会动荡?还是个人遭遇的重大变故?更让我感兴趣的是,在这样一种“一触即溃”的局面下,书中人物会呈现出怎样的反应?是绝望的挣扎?是出人意料的坚韧?还是在混乱中寻找一丝希望?我特别期待作者能够捕捉到那种在压力下,人性中最脆弱和最坚强的一面。我希望这本书能够让我感受到一种强烈的代入感,仿佛自己也置身于那个“边缘”,去体会那种心跳加速、呼吸困难的紧张感,同时也能从中学习到,在面对困境时,如何保持冷静和理智,甚至能够激发出超越自身极限的力量。

评分我对《On the Brink》的期待,很大程度上源于我最近对“边界”这个概念的思考。我们的人生,无论是在人际关系、职业发展还是个人成长中,似乎总是在不断地试探和跨越各种边界。而这本书的书名,直接点出了这种“边缘”的状态,让我对其中可能蕴含的深刻哲思产生了浓厚的兴趣。我猜测,作者可能是在描绘一个故事,主人公正站在人生的一个岔路口,面临着一个决定性的选择,而这个选择将彻底改变他/她的人生轨迹。这个“边缘”可能是事业的瓶颈,可能是情感的危机,也可能是对自身价值的质疑。我很好奇,作者将如何构建这样一个充满张力的情节,让读者在阅读过程中,也能感受到主人公的焦虑和挣扎。我尤其期待作者对人物内心世界的深入挖掘,是否能展现出他们在面对未知和风险时,内心的矛盾、恐惧与渴望。我希望这本书能够引发我对自己人生边界的思考,让我重新审视那些我曾经犹豫过、甚至逃避过的“边缘”,并从中获得一些勇气和启示。

评分初翻开《On the Brink》,我并没有立刻被剧情吸引,反而是在作者的遣词造句中感受到了某种奇特的力量。那不是那种直白的、急促的煽动,而是一种不动声色的铺陈,像在描绘一幅画,每一个笔触都充满了暗示,却又不急于点明主题。我总觉得,有些作者善于用一种极度克制的笔调,来营造出最令人不安的张力,而这本书似乎就是如此。我开始揣摩,这种“边缘”究竟是以一种怎样的方式被呈现出来的?是某个角色的内心世界,因为某种巨大的创伤或长期的压抑,已经濒临失控的边缘?还是说,某种外部的、不可逆转的事件,正在悄无声息地逼近,改变着一切原有的秩序?我一直在留意作者对细节的描绘,那些看似微不足道的场景,人物不经意间的一个动作,或者是一段对话中的停顿,都在我脑海中被放大,成为解读故事走向的线索。我喜欢那种需要读者主动去思考、去感受的书,而不是一股脑地将信息倾倒给你。《On the Brink》给我的感觉,就是这样一本需要你去慢慢品味,去挖掘其深层含义的作品。我期待作者能用她独特的叙事方式,带领我走进一个充满隐喻和象征意义的世界,去体会那种在看似平静表面下涌动的暗流。

评分读《On the Brink》的过程,就像在黑暗中摸索,时不时地会碰到一些尖锐的东西,让你猛地惊醒。我最开始以为这会是一本纯粹的关于危机管理的书,但读下去之后,我发现它远不止于此。作者似乎在用一种非常规的手法,去探讨“边缘”所代表的,不仅仅是某种物理上的临界点,更是一种精神上的、存在上的困境。我一直在思考,书中的人物是如何在这种“边缘”状态下生存的?他们是否还在努力挣扎,试图回到安全的地带,还是已经开始接受、甚至拥抱这种不确定性?我尤其对那些在极端环境下展现出人性的复杂性的人物描绘感到着迷。作者是否能够刻画出,当所有的支撑都开始崩塌时,人们内心深处的恐惧、希望、甚至是残存的尊严?我还在琢磨,这种“边缘”是否也暗示着某种转折的可能性?是走向毁灭,还是迎来新生?我期待作者能够提供一种全新的视角,来审视我们所处的这个充满不确定性的时代,去思考我们在面对巨大挑战时,应该如何去定义和超越“边缘”。这本书让我有一种,即使身处绝境,也仍有思考和选择的空间的感觉。

评分这本书,我真的拖了很久才开始读,你知道的,有些书名就像一种承诺,也像一种预警。“On the Brink”,光是这个名字就让我有点心悸,好像一翻开就要跌入某种深渊,或者站在某个悬崖边上。我通常喜欢那些让人轻松的书,但最近生活里确实有一些事情,让我觉得好像也置身于某种“边缘”,所以鬼使神差地就拿起了它。读之前,我脑海里勾勒的场景是那种紧绷到极致的心理悬疑,或者是某种重大危机前的暗流涌动。我一直在想,作者会如何描绘那种一触即破的氛围,人物在这种极端压力下会做出怎样的选择,他们内心的挣扎又该如何被细腻地展现出来。我特别关注的是,故事的节奏感如何把握,是那种娓娓道来、步步为营,还是猝不及防地将读者抛入混乱之中。同时,我也很好奇,究竟是什么样的“边缘”?是个人情感的崩溃?社会的动荡?还是某种更宏大的、我们无法逃避的命运?我对作者能否在悬念的设置上做到出人意料,同时又不失逻辑性,这一点尤为期待。我希望这本书能够带我经历一场酣畅淋漓的情感过山车,让我暂时忘却现实的烦恼,沉浸在故事的世界里,去体会那些极端的情绪和境遇。

评分一个奇怪感受,不一定对:“诚恳坦率”会不会是“老奸巨猾”一种高级形式;Hank Paulson这样的人不可能不是人精中的人精老油条,他的每一步所作所为不可能没有算计权衡,只是如此诚恳,且毫不掩饰地展现出来自己的每一个逻辑和动因,的确不由得让人心生钦佩 #见证历史

评分Not as captivating as hoped. long and blandish. maybe useful as for public policy makers. He served for a republican president

评分Interesting and insightful, but not very candid.

评分这种历史事件本身不需要太多的修辞,阅读历史本身已经是无比精彩的体验。这本书最出彩的,无疑是提供了08年起 尤其是9月到12月间呢些事情细节的详细描写,了解金融危机必看之书。

评分hard to believe account from an industry insider ...

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 book.quotespace.org All Rights Reserved. 小美书屋 版权所有