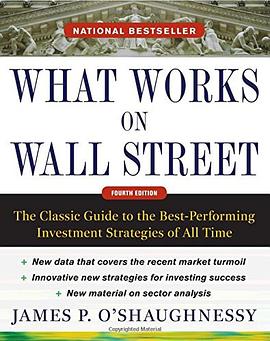

What Works on Wall Street, Fourth Edition pdf epub mobi txt 電子書 下載2025

- 投資

- 因子模型

- 金融

- 量化

- 股票

- 生活

- 投資哲學

- 投資交易

- 投資

- 股票

- 價值投資

- 成長投資

- 量化投資

- 選股

- 財務分析

- 市場策略

- 投資組閤

- 投資技巧

具體描述

Historically tested long-term strategies that "always" outperform the market "O'Shaughnessy's conclusion that some strategies do produce consistently strong results while others underperform could shake up the investment business."

--"Barron's" ""What Works on Wall Street" is indisputably a major contribution to empirical research on the behavior of common stocks in the United States. . . . Conceivably, the influence of "What Works on Wall Street" will prove immense."

--"The Financial Analysts' Journal" "O'Shaughnessy's latest, "What Works on Wall Street," is a serious inquiry into the investment strategies that stand up under long-term scrutiny and is refreshing research for every investor."

--"Stocks and Commodities" Recent history has witnessed one of the worst stock market beatings ever. As a result, abysmal returns are being called "the new normal," financial "experts" are ringing the death knell of buy-and-hold, and investors' faith in equities has hit an all-time low. You have two choices. You can abandon the stock market based on what is happening today. Or you can invest today based on what will happen in the future. Containing all new data, "What Works on Wall Street," Fourth Edition, is the only investing guide that lets you see today's market in its proper context-- as part of the historical ebb and flow of the stock market. And when you see the data, you'll see there is no argument: Stocks work. Now in its second decade of helping investors succeed with stocks, "What Works on Wall Street" continues to provide the most effective investing strategies, presenting incontrovertible data on what works and what doesn't. Updated with current statistics and brand-new features, "What Works on Wall Street" offers data on almost 90 years of market performance, including: Stocks ranked by market capitalizationPrice-to-earnings ratiosEBITDA to enterprise valuePrice-to-cash flow, -sales, and -book ratiosDividend, buyback, and shareholder yieldsOne-year earnings-per-share percentage changes Providing you with unparalleled insights into stock performance going back to 1926, "What Works on Wall Street" is a refreshingly calming, objective view of a subject that is usually wrapped in drama, hyperbole, and opinions that are plain wrong. This comprehensive guide provides the objective facts and winning strategies you need; all you have to do is make the decision to ignore the so-called market experts and rely on the long-proven approach that has made "What Works on Wall Street" an investing classic.

著者簡介

詹姆斯·奧肖內西,奧肖內西資産管理公司主席兼CEO,該公司是一傢位於康涅狄格州的資産管理公司。奧肖內西曾在貝爾斯登擔任投資組閤經理、係統證券主任與高級管理主任。他是證券定量化分析與投資管理領域的專傢。同時他還善於投資模型與調研決策係統的運作。從1995年開始。他就將標準普爾數據庫的投資策略數據進行定量化分析,並將結果整理到他的著作《投資策略實戰分析》中,這本書是馳名華爾街的經典暢銷書。奧肖內西因其投資策略而榮獲美國專利,並被福布斯網站評為最傳奇的投資者之一。

圖書目錄

讀後感

1、投资策略长期会向其长期均值回归 2、人的非理性,知易行难 3、small cap去掉micro cap之后,效果变弱。micro很难介入,操作性差。 “当你使用本书中所强调的投资策略来寻求最大收益时,你最终只会选择小盘股以及micro股票。我认为这不只是市值的原因,而是因为这类股票的定...

評分 評分1、大市值低PE,回避小市值低PE。要买小市值高PE,预示着成长性。 2、每股账面价值与股价的比率测试。买低股价/账面价值比的大盘股,收益高于大盘股复合收益两倍,且夏普比率高,稳定性和策略持续性强。 3、最牛就是市销比,低市销比选股策略是对照值得五倍,而且大盘股的稳...

評分 評分很不错,给五星。理念是行为金融学解释了市场定价可能是错的,方法是通过量化回测找出长期定价错误发生概率最大的那一类股票,结论很明确。虽然不一定可以直接应用到A股,但非常值得参考…… 倒数第二章的最后一部分是精华,用整本书700页的量化分析最后导出结论:价值投资(价...

用戶評價

價值因子和成長因子的模型分析。沒考慮稅收因素。

评分rich in data, poor in theory. layman's quant value encyclopaedia

评分rich in data, poor in theory. layman's quant value encyclopaedia

评分rich in data, poor in theory. layman's quant value encyclopaedia

评分價值因子和成長因子的模型分析。沒考慮稅收因素。

相關圖書

本站所有內容均為互聯網搜索引擎提供的公開搜索信息,本站不存儲任何數據與內容,任何內容與數據均與本站無關,如有需要請聯繫相關搜索引擎包括但不限於百度,google,bing,sogou 等

© 2025 book.quotespace.org All Rights Reserved. 小美書屋 版权所有