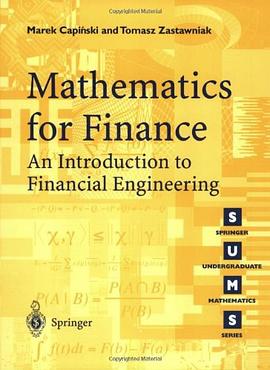

Mathematics for Finance pdf epub mobi txt 電子書 下載2025

- 數學

- 金融

- finance

- 教材

- financial

- engineering

- 投資

- 量化

- 金融數學

- 數學金融

- 金融工程

- 量化金融

- 投資

- 期權定價

- 隨機過程

- 利率模型

- 風險管理

- 金融建模

具體描述

Designed to form the basis of an undergraduate course in mathematical finance, this book builds on mathematical models of bond and stock prices and covers three major areas of mathematical finance that all have an enormous impact on the way modern financial markets operate, namely: Black-Scholes arbitrage pricing of options and other derivative securities; Markowitz portfolio optimization theory and the Capital Asset Pricing Model; and interest rates and their term structure. Assuming only a basic knowledge of probability and calculus, it covers the material in a mathematically rigorous and complete way at a level accessible to second or third year undergraduate students. The text is interspersed with a multitude of worked examples and exercises, so it is ideal for self-study and suitable not only for students of mathematics, but also students of business management, finance and economics, and anyone with an interest in finance who needs to understand the underlying theory.

著者簡介

馬雷剋·凱賓斯基,波蘭礦業也近學院應用數學係教授,研究領域包括數學金融、公司金融、信貸風險、有價證券、隨機分析等。曾齣版多本有關金融方麵的教材和學術著作,在著名期刊發錶論文50多篇。

圖書目錄

讀後感

評分

評分

評分

評分

用戶評價

入門,學術性,離散...

评分umich 的教材,看著蠻淺的

评分答案有一些小錯

评分入門,學術性,離散...

评分有點淺

相關圖書

本站所有內容均為互聯網搜索引擎提供的公開搜索信息,本站不存儲任何數據與內容,任何內容與數據均與本站無關,如有需要請聯繫相關搜索引擎包括但不限於百度,google,bing,sogou 等

© 2025 book.quotespace.org All Rights Reserved. 小美書屋 版权所有