具体描述

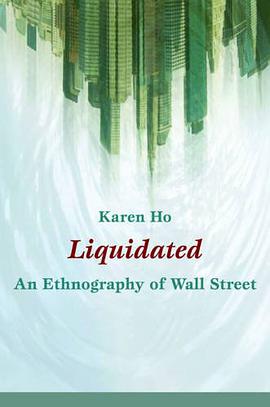

Financial collapses--whether of the junk bond market, the Internet bubble, or the highly leveraged housing market--are often explained as the inevitable results of market cycles: What goes up must come down. In Liquidated, Karen Ho punctures the aura of the abstract, all-powerful market to show how financial markets, and particularly booms and busts, are constructed. Through an in-depth investigation into the everyday experiences and ideologies of Wall Street investment bankers, Ho describes how a financially dominant but highly unstable market system is understood, justified, and produced through the restructuring of corporations and the larger economy. Ho, who worked at an investment bank herself, argues that bankers' approaches to financial markets and corporate America are inseparable from the structures and strategies of their workplaces. Her ethnographic analysis of those workplaces is filled with the voices of stressed first-year associates, overworked and alienated analysts, undergraduates eager to be hired, and seasoned managing directors. Recruited from elite universities as "the best and the brightest," investment bankers are socialized into a world of high risk and high reward. They are paid handsomely, with the understanding that they may be let go at any time. Their workplace culture and networks of privilege create the perception that job insecurity builds character and employee liquidity results in smart, efficient business. Based on this culture of liquidity and compensation practices tied to profligate deal-making, Wall Street investment bankers reshape corporate America in their own image. Their mission is the creation of shareholder value, but Ho demonstrates that their practices and assumptions often produce crises instead. By connecting the values and actions of investment bankers to the construction of markets and the restructuring of U.S. corporations, Liquidated reveals the particular culture of Wall Street often obscured by triumphalist readings of capitalist globalization.

作者简介

何柔宛(Karen Ho),普林斯顿大学人类学博士,明尼苏达大学人类学系教授,研究方向为华尔街制度文化、美国企业裁员现象和新自由主义。

目录信息

读后感

在这个全球化时代,美国的金融中心华尔街,早已不仅仅是美国的标志和骄傲,更是全世界关注的焦点。华尔街的独特文化与华尔街人的生活,也随之成为了很多企业、很多人争相了解和模仿的标杆。 然而,那些衣着光鲜的华尔街人,却有着另外一个偏僻入里的名字——“走钢丝的幸运儿”...

评分这是一个一堆之前大约除了去银行存钱之外从没了解过金融业的人,也能靠着几段舶来的对于CDS或是MBS的评论,指着金融衍生品摇头说,“坏极坏极”的时代。 大约从2008年9月以来(甚至更早),金融业便变得名声狼籍,几乎被扣上祸国殃民的帽子。在美国,“贪婪短视”的银行...

评分说起来非常讽刺:想在华尔街混得好,最重要的居然是人际关系。这就揭示了华尔街只要顶级名校生的真实原因。说他们最聪明只是噱头,华尔街真正看中的是人际关系。顶级名校生的人际关系能带来高端客户,创造收益。在采访中,有投行家就直接跟何柔宛说:靠博学多才就能达成交易吗...

用户评价

所以说我可以给。。某些人写作业不是吹牛的。

评分人类学家,人种学家,来研究华尔街,咋一看,跨界嘛,再一想,啊,华尔街的人和我们已经不是一个人种了!不过这样的混合,确实带来了新的视野和观点,好书!

评分人类学家,人种学家,来研究华尔街,咋一看,跨界嘛,再一想,啊,华尔街的人和我们已经不是一个人种了!不过这样的混合,确实带来了新的视野和观点,好书!

评分所以说我可以给。。某些人写作业不是吹牛的。

评分所以说我可以给。。某些人写作业不是吹牛的。

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 book.quotespace.org All Rights Reserved. 小美书屋 版权所有