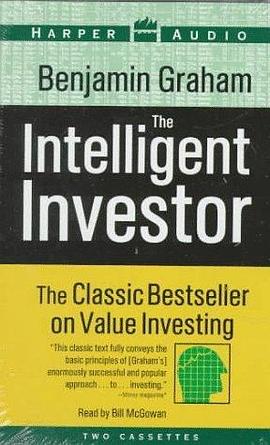

The Intelligent Investor pdf epub mobi txt 电子书 下载 2026

- 金融

- 投资

- 管理

- investment

- 成长

- 思维

- finance

- 英文原版

- 投资理财

- 价值投资

- 股票市场

- 金融学

- 财务管理

- 长期投资

- 聪明的投资者

- 巴菲特推荐

- 经典书籍

- 个人财富

具体描述

<DIV align=center><EM>"This classic text fully conveys the basic principles of [Graham's] enormously successful and popular approach . . . to . . . investing." -Money magazine </EM></DIV>

The classic bestseller by Benjamin Graham, perhaps the greatest investment advisor of the Twentieth Century, The Intelligent Investor has taught and inspired hundreds of thousands of people worldwide. Since its original publication in 1949, Benjamin Graham's book has remained the most respected guide to investing, due to his timeless philosophy of "value investing" which helps protect investors against areas of (possible) substantial error, and teaches them to develop long-term strategies with which they will be comfortable down the road.

Over the years, market developments have borne out the wisdom of Benjamin Graham's basic policies. Here he takes account of both the defensive and the enterprising investor, outlining the principles of stock selection for each, and stressing the advantages of a simple portfolio policy. This tape demonstrates that the continued success of common stocks cannot be taken for granted. Among its special features are the use of numerous comparisons of pairs of common stocks to bring out their elements of strength and weakness, and also the construction of investment portfolios designed to meet specific requirements of quality and price attractiveness.

Benjamin Graham (1894-1976), the father of value investing, was perhaps the most influential investor of all time. His books are investment classics, with The Intelligent Investor (first published in 1949) and Securities Analysis (1934) selling steadily. His life and work have been inspiration for many of today's most successful businessmen, including Warren Buffett.

Bill McGowan, a two-time Emmy award winner, has been a corespondent and anchor for several nationally syndicated television series over the past decade. </P>

作者简介

本杰明•格雷厄姆(Benjamin Graham,1894~1976年)美国经济学家和投资思想家,投资大师, “现代证券分析之父”, 价值投资理论奠基人。格雷厄姆生于伦敦,成长于纽约,毕业于哥伦比亚大学。著有《证券分析》(1934年)和《聪明的投资者》(1949年),这两本书被公认为“划时代的、里程碑式的投资圣经”,至今仍极为畅销。格雷厄姆不仅是沃伦•巴菲特就读哥伦比亚大学经济学院的研究生导师,而且被巴菲特膜拜为其一生的“精神导师”,“血管里流淌的血液80%来自于格雷厄姆”。格雷厄姆在投资界的地位,相当于物理学界的爱因斯坦,生物学界的达尔文。作为一代宗师,他的证券分析学说和思想在投资领域产生了极为巨大的震动,影响了几乎三代重要的投资者。如今活跃在华尔街的数十位上亿的投资管理人都自称为格雷厄姆的信徒,因此,享有“华尔街教父”的美誉。

贾森•兹威格(Jason Zweig)《华尔街日报》投资与个人理财高级专栏作家。早先,他曾是《货币》杂志和《时代周刊》的资深专栏记者,《福布斯》共同基金专栏主编。从1987年他开始撰写投资方面的文章,是华尔街有影响力的资深财经传媒记者。

目录信息

读后感

附巴菲特推荐的十本书: 1、《聪明的投资者》(格雷厄姆著)。格雷厄姆专门为业余投资者所著,巴菲特称之为“有史以来最伟大的投资著作”。 2、《穷光蛋查理年鉴》(富兰克林著)(一个不幸的灵魂去年问查理:“如果感受不到阅读本书的喜悦,该怎么办?...

评分《聪明的投资者》是巴菲特的导师本杰明.格雷厄姆的经典之作,此书写得实在太棒。 一句话概括投资的全部秘诀:以显著的安全性标准寻找价值与价格的差异。 一段话说明投资的全部秘诀 1.投资就是价值投资,巴菲特同志认为:投资这个词的前面本无必要加上价值一词,如果不是价值...

评分有个村庄的小康之家的女孩子,生得美,有许多人来做媒,但都没有说成。 那年她不过十五六岁吧,是春天的晚上,她立在后门口,手扶着桃树。她记得她穿的是一件月白的衫子。对门住的年轻人同她见过面,可是从来没有打过招呼的,他走了过来,离得不远,站定了,轻轻地...

评分有个村庄的小康之家的女孩子,生得美,有许多人来做媒,但都没有说成。 那年她不过十五六岁吧,是春天的晚上,她立在后门口,手扶着桃树。她记得她穿的是一件月白的衫子。对门住的年轻人同她见过面,可是从来没有打过招呼的,他走了过来,离得不远,站定了,轻轻地...

评分这本书不是教你如何在市场上获利的一些方法,而是以一个智者的方式说明什么是投资和投机,同时告诫远离投机,用智慧的方式对待市场。

用户评价

我一直认为投资是一件非常复杂的事情,需要大量的专业知识和信息。然而,当我读到《聪明的投资者》时,我的看法彻底改变了。格雷厄姆用一种极其清晰和易于理解的方式,向我展示了投资的本质。他将投资者分为“防御型投资者”和“积极型投资者”,并为这两种类型的投资者提供了不同的投资策略。对于我这样的普通人来说,格雷厄姆的“防御型投资”策略,让我感到非常安心。他强调了投资的“安全边际”,也就是在购买股票时,要确保其价格远低于其内在价值。这意味着,即使公司遇到一些困难,我们的投资也不会遭受毁灭性的打击。他所倡导的,是通过研究公司的财务报表,如盈利、资产、负债等,来评估其内在价值,并从中寻找那些被市场低估的优质公司。书中的“市场先生”的比喻,更是让我理解了市场的波动性。市场先生就像一个情绪化的交易对手,他会时不时地给出非常便宜或者非常昂贵的价格。聪明的投资者,就是要利用市场先生的情绪化,在他给出便宜价格时买入,在他给出昂贵价格时卖出。这种“逆向思维”,让我看到了在市场波动中获利的机会。这本书不仅仅是一本关于投资的书,它更是一种思维方式的启蒙,让我学会了如何理性地分析问题,如何做出明智的决策,从而更好地规划自己的人生。

评分《聪明的投资者》这本书,是我金融启蒙的开端,它以一种极其清晰和逻辑严谨的方式,为我揭示了投资的真谛。在阅读之前,我曾对股票市场充满了敬畏,认为这是一个只有专业人士才能驾驭的领域。然而,格雷厄姆的书,彻底改变了我的看法。他将投资描述为一项基于理性和纪律的商业行为,而非一场高风险的赌博。他深入浅出地解释了“市场先生”的概念,将市场波动比作一个情绪化的交易伙伴。聪明的投资者,就是要利用市场先生的非理性,在他恐慌时买入,在他狂热时卖出,而不是被他的情绪所左右。这让我明白了“逆向投资”的精髓。同时,他对“安全边际”的强调,更是我投资决策的基石。它教会我,在购买股票时,一定要确保价格远低于其内在价值,为我的投资提供一层坚实的保障,以应对市场的不可预测性。书中所提供的分析公司的方法,虽然不涉及复杂的数学公式,但却极其实用。通过对公司盈利、资产负债、股息政策等基本面的深入研究,我学会了如何判断一家公司的真实价值,并从中寻找那些被市场低估的投资机会。这本书不仅传授了投资技巧,更重要的是,它培养了一种正确的投资哲学和思维模式,让我更加审慎地对待金钱,并学会了耐心等待价值的回归。

评分读完《聪明的投资者》,我感觉自己像是获得了一把解锁财富密码的钥匙。在此之前,我对于投资的理解,更多的是一种“碰运气”的心态,总觉得需要敏锐的市场洞察力和一点点运气才能成功。然而,格雷厄姆的书,用一种极其务实和深刻的方式,让我明白了投资的本质在于理性分析和长期坚持。他所阐述的“市场先生”理论,对我影响至深。市场先生就像一个反复无常的伙伴,他每天都会给出不同的报价,有时极低,有时极高。聪明的投资者,就是要利用市场先生的非理性,在他给出优惠价格时买入,在他给出昂贵价格时卖出,而不是被他的情绪左右。这让我意识到,市场的波动恰恰是创造财富的机会。此外,他对“安全边际”的强调,更是我投资的核心原则。这意味着,在购买股票时,价格一定要远低于其内在价值,为我的投资提供一个缓冲,以应对可能出现的风险。这种审慎的态度,让我避免了许多盲目的追高和冲动的交易。他对于“防御型投资者”和“积极型投资者”的区分,也帮助我找到了更适合自己的投资路径。我更倾向于成为一名防御型投资者,专注于那些经营稳健、财务健康的优质公司,并长期持有,享受复利带来的增长。这本书不仅仅是一本关于投资的书,更是一本关于如何独立思考、如何理性决策的智慧之书,它对我的生活也产生了积极的影响。

评分这是一本真正改变了我看待金钱和投资方式的书。在接触《聪明的投资者》之前,我一直认为投资是一种高风险、高回报的博弈,需要敏锐的直觉和大量的运气。然而,格雷厄姆的著作彻底颠覆了我的认知。他将投资描绘成一种基于理性分析、纪律性和长期视野的商业行为。他强调了“市场先生”的概念,将其比作一个情绪化的交易伙伴,时而乐观,时而悲观,其价格波动并不总是反映公司的真实价值。这让我明白,作为投资者,我们不应该被市场的短期波动所左右,而是要学会利用市场的非理性情绪来寻找被低估的投资机会。格雷厄姆深入浅出地阐述了“安全边际”的重要性,将其视为投资者保护自己免受损失的关键。他详细介绍了如何通过分析公司的财务报表,如收益、股息、资产负债情况,来评估一家公司的内在价值,并在此基础上寻找那些价格低于其内在价值的股票。这种基于价值的投资策略,让我从一个追逐市场热点的“赌徒”变成了一个注重基本面分析的“企业主人”。他对于“防御型投资者”和“积极型投资者”的区分,也帮助我找到了适合自己的投资路径。作为一个普通工薪阶层,我更倾向于防御型投资,即选择那些经营稳健、财务健康的蓝筹股,并长期持有,享受复利增长的魔力。这本书不仅仅是一本关于投资的书,更是一本关于如何理性思考、如何做出明智决策的书,它对我的人生规划也产生了深远的影响,让我更加审慎地对待生活中的每一个选择。

评分我一直对金融市场充满了好奇,但又畏惧于其复杂性和不确定性。在朋友的推荐下,我翻开了《聪明的投资者》,这本书以一种极其朴实且逻辑严谨的方式,为我揭示了投资的真谛。格雷厄姆并没有使用晦涩难懂的专业术语,而是用清晰的语言解释了诸如“内在价值”、“市场先生”、“安全边际”等核心概念。他通过大量生动的例子,展示了如何在纷繁复杂的市场波动中保持冷静,并作出理性的投资决策。书中关于“市场先生”的描述尤为令我印象深刻。市场就像一个喜怒无常的伙伴,他会根据自己的情绪给出不同的报价。聪明的投资者要做的是,在市场先生情绪低落、报价过低时买入,在情绪高涨、报价过高时卖出,而不是盲目跟随他的喜怒哀乐。这种“逆向投资”的思维方式,让我意识到,大众的恐慌和贪婪恰恰是创造财富的机会。此外,格雷厄姆对于“安全边际”的强调,让我明白,任何一项投资都应该有一个缓冲地带,以应对无法预测的风险。他教会我如何通过对公司基本面的深入分析,来确定一个股票的价值区间,然后只在价格低于其价值时才出手。这种审慎的态度,让我避免了许多冲动性的投资行为。这本书不仅仅传授了投资技巧,更重要的是培养了一种正确的投资哲学和思维模式,它让我明白,投资是一个长期而有耐心的过程,需要的是智慧和纪律,而非猜测和赌博。

评分这本书的价值,远不止于金融投资本身,它更教会了我一种审慎的、以逻辑为基础的思考方式。在接触《聪明的投资者》之前,我对投资的理解,很大程度上受到大众媒体和市场情绪的影响,总觉得需要“抓住机会”,才能获得高回报。格雷厄姆用他朴实无华的语言,为我揭示了投资的本质:它是一项商业行为,而不是一场赌博。他强调了“安全边际”的重要性,这意味着在购买股票时,价格应该远低于其内在价值。这就像在购买任何商品时,都会寻求折扣一样,为自己的投资提供了一层保障。他所提出的“市场先生”的比喻,更是让我深刻理解到市场的非理性。市场先生每天都会给出不同的价格,有时非常优惠,有时则高得离谱。聪明的投资者,就是要利用市场先生的非理性,在他情绪低落、价格便宜时买入,而在他情绪高涨、价格昂贵时卖出。这种“逆向思维”,让我不再盲目追逐市场热点,而是学会了独立思考,寻找那些被市场低估的优质资产。他对于“防御型投资者”和“积极型投资者”的区分,也帮助我更好地认识自己,并选择适合自己的投资策略。我更倾向于成为一名防御型投资者,专注于那些经营稳健、财务健康的大盘股,并长期持有,享受复利的增长。这本书让我明白,真正的投资智慧,在于理性、耐心和对风险的敬畏。

评分《聪明的投资者》这本书,可以说是开启了我对价值投资的全新认知。在阅读之前,我曾尝试过各种所谓的“技术分析”,试图通过捕捉市场的短期波动来获利,但结果往往是令人沮丧的。格雷厄姆用他深厚的金融功底和丰富的实践经验,为我指明了一条更加光明和可持续的道路。他首先就明确了“投资者”与“投机者”的区别,并强调了作为一名投资者,我们应该像一个企业的所有者一样去思考。这意味着我们需要深入了解我们所投资的公司,理解其商业模式、盈利能力以及未来的增长潜力。他提出的“市场先生”理论,更是成为了我投资决策的重要指导。市场先生就像一个被情绪左右的家伙,他会时不时地用非常诱人的价格提供股票,也会用夸张的估值让你望而却步。聪明的投资者,就是要利用市场先生的非理性,在他恐慌时买入,在他狂热时退出,而不是被他牵着鼻子走。而“安全边际”的概念,则是让我理解到,任何投资都应该有一个“缓冲”,以应对那些我们无法预测的风险。只有当股票的价格远低于其内在价值时,我们才应该买入。这是一种审慎的、保守的投资策略,但正是这种策略,能够最大程度地保护我们的本金,并为我们带来稳健的回报。这本书不仅仅是一本投资指南,更是一本关于如何理性思考、如何做出明智决策的人生哲学书。

评分第一次接触《聪明的投资者》,是在我刚开始接触股票市场的时候。我当时抱着一种“速成”的心态,希望能找到快速致富的秘诀,结果可想而知,我在市场的波动中屡屡碰壁。这本书就像一盏明灯,照亮了我前行的方向。格雷厄姆用他深入浅出的语言,阐述了价值投资的核心理念,让我明白,投资并非投机,而是对一家企业的长期持有和分享其成长的过程。他强调了“安全边际”的重要性,即在购买股票时,要确保其价格远低于其内在价值。这就像给自己的投资上了一道保险,即使市场出现意外波动,也能最大程度地保护本金。书中的“市场先生”的比喻,更是让我领悟到,市场情绪往往是非理性的。市场先生时而狂喜,时而悲观,他给出的价格并不总是反映公司的真实价值。聪明的投资者,就是要利用市场先生的非理性,在他低迷时买入,在他亢奋时卖出。这种“逆向投资”的思维,让我从一个追逐市场热点的小白,转变成一个注重基本面分析的理性投资者。他对于“防御型投资者”和“积极型投资者”的区分,也帮助我找到了适合自己的投资路径。我更倾向于成为一名防御型投资者,通过选择那些经营稳健、财务健康的蓝筹股,长期持有,并享受复利的魅力。这本书不仅教会我如何投资,更重要的是,它培养了我一种审慎、理性和长远的思维方式。

评分读完《聪明的投资者》,我感觉自己像是经历了一场深刻的思维重塑。在此之前,我对于投资的理解,很大程度上受到了市场噪音和大众情绪的影响。我曾试图通过预测市场走向来获利,但这种方式带来的结果总是令人失望。格雷厄姆的著作,如同一剂“镇定剂”,让我从浮躁的市场情绪中抽离出来,回归到理性和基本面的分析。他所提出的“市场先生”的概念,堪称点睛之笔。市场先生每天都会提供一个价格,有时极高,有时极低,但他并非总是理性的。聪明的投资者,就是要像一个冷静的观察者,在市场先生情绪低落、报价过低时,以优惠的价格买入优质的资产,而在他情绪亢奋、报价过高时,则选择卖出。这种“逆向投资”的策略,让我明白,大众的恐慌和贪婪,恰恰是创造超额回报的良机。而“安全边际”的理念,更是我投资决策的基石。它告诉我,任何一项投资都应该有一个缓冲,以应对那些我们无法预料的风险。只有当股票的价格远低于其内在价值时,我们才应该出手。这是一种审慎的、风险控制的投资方式,它让我避免了许多盲目追高的行为,也保护了我的本金免受不必要的损失。这本书不仅仅是一本投资指南,更是一本关于如何理性地思考、如何独立地做出决策的哲学著作。

评分《聪明的投资者》这本书,对我而言,不仅仅是一本投资的入门读物,更是一本关于如何在这个充满不确定性的世界中做出明智决策的哲学指南。在阅读这本书之前,我对投资的理解停留在“追涨杀跌”的层面,常常被市场的短期波动所裹挟,做出冲动性的决策。格雷厄姆以他严谨的逻辑和生动的案例,彻底颠覆了我的认知。他将投资者与投机者进行了清晰的界定,并强调了作为一名投资者,我们的目标应该是“保本”和“合理的收益”。他提出的“市场先生”理论,让我明白了市场的非理性。市场先生就像一个情绪不稳定的朋友,时而用极低的价格抛售股票,时而又用极高的价格鼓吹买入。聪明的投资者,就是要利用市场先生的非理性,在他悲观时买入,在他乐观时卖出,而不是被他的情绪所左右。而“安全边际”的概念,更是让我理解到,任何一项投资都应该有一个“缓冲”,以应对那些我们无法预料的风险。只有当股票的价格远低于其内在价值时,才应该出手。这是一种审慎的、风险控制的投资策略,它让我更加关注公司的基本面,而非市场的短期波动。他对于“防御型投资者”和“积极型投资者”的区分,也帮助我找到了适合自己的投资路径。我更倾向于采取防御型的投资策略,选择那些经营稳健、财务健康的蓝筹股,并长期持有,享受复利带来的增长。这本书给我最大的启示是,投资是一场马拉松,而非短跑,需要的是耐心、纪律和理性。

评分在成书时代,不愧为杰作,时至今日,由于内容多数已为大众熟悉,难免沦为老生常谈。然而作者写作之严谨,用词之考究,用例之倾心,仍不愧为经典。

评分投机需若尚存理智的赌徒,只带100美元去赌场前,不会忘记把棺材本锁在家里保险柜。而若投资,同样需要先把棺材本给留下。

评分在成书时代,不愧为杰作,时至今日,由于内容多数已为大众熟悉,难免沦为老生常谈。然而作者写作之严谨,用词之考究,用例之倾心,仍不愧为经典。

评分看完的结论是,我永远不可能成为aggressive investors。女怕入错行@@

评分在成书时代,不愧为杰作,时至今日,由于内容多数已为大众熟悉,难免沦为老生常谈。然而作者写作之严谨,用词之考究,用例之倾心,仍不愧为经典。

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 book.quotespace.org All Rights Reserved. 小美书屋 版权所有